First Time Homebuyer

Buying Your First Home is an Exciting Time

We provide first time homebuyer loans for down payment assistance, closing costs and the first mortgage loan.

The down payment assistance can be paired with FHA,VA and Conventional Loans to fund 100% of the purchase price or pay for closing costs. You come in with zero down payment. Additional Loans up to 2.5% of the purchase price are available to pay for closing costs. The down payment assistance and additional loans are deferred to match the term of your first loan and do not require monthly payment. They are available at 1% deferred simple interest per annum.

First Time homebuyers falling below the 80% area median income limits get lower interest and mortgage insurance.

Our in house underwriting and funding of your first mortgage, down payment assistance and additional loans offers a smooth and streamlined loan experience.

We want to be part of your Journey!

We believe finding the perfect home is a life-changing experience, not just a transaction. Whether you’re upsizing, downsizing, or starting fresh, we’re here to guide you with trust, care, and expertise every step of the way.

Prior to commencing your home search, it is imperative to ascertain your comfortable affordability.

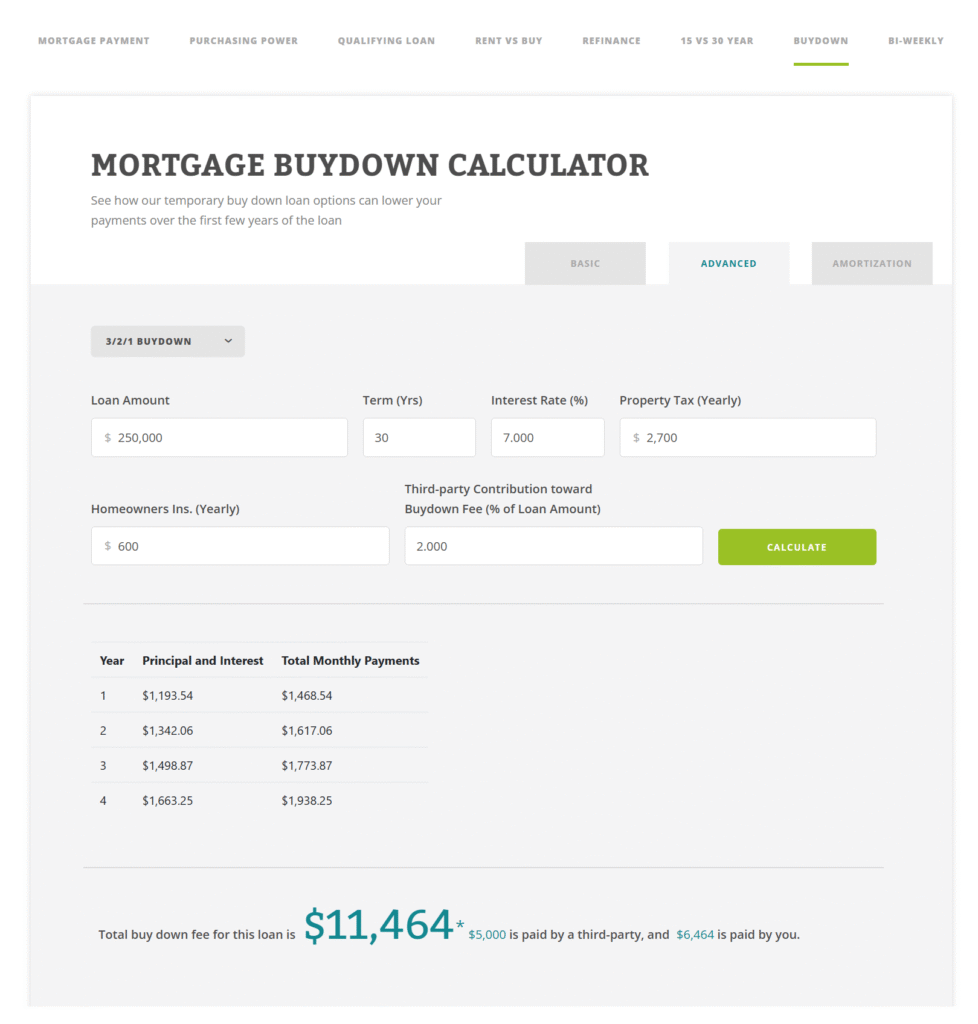

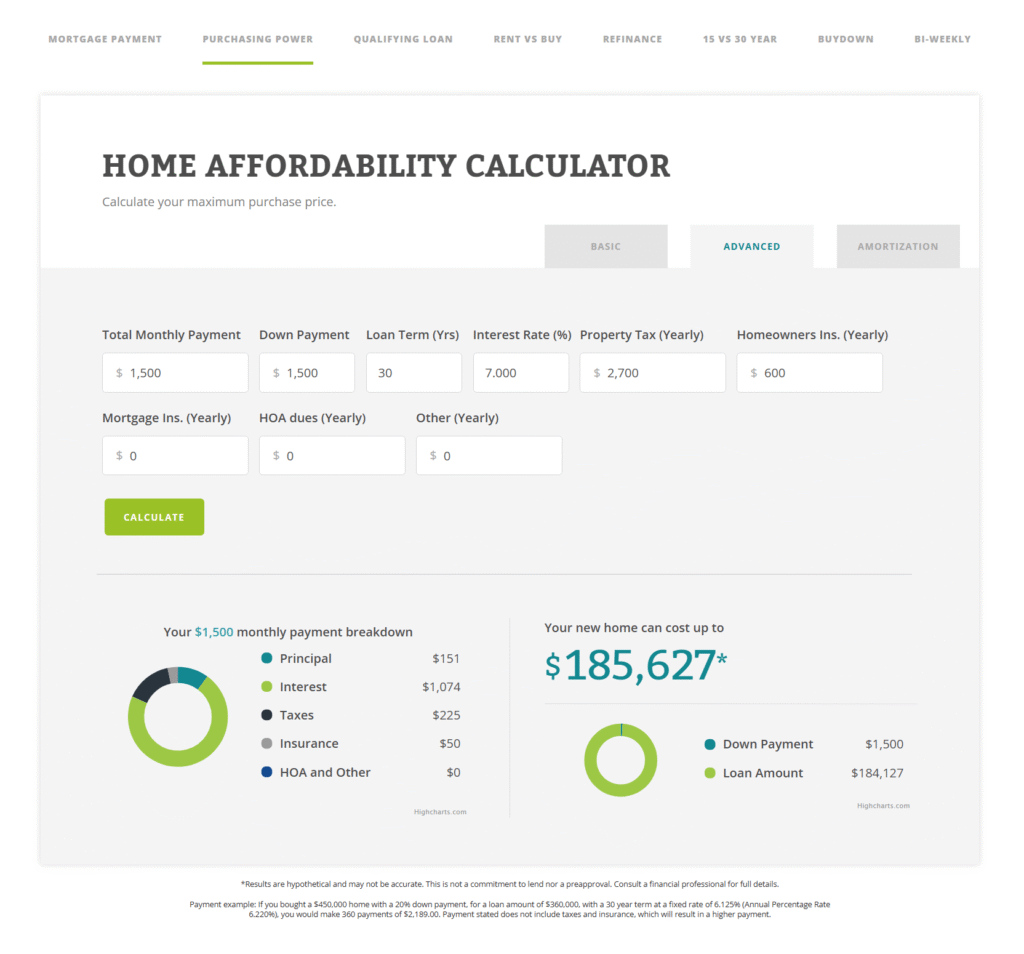

Mortgage Calculator

Our intuitive homebuying calculators are designed to assist you in estimating your purchasing power, projected monthly payments, and other crucial financial considerations.

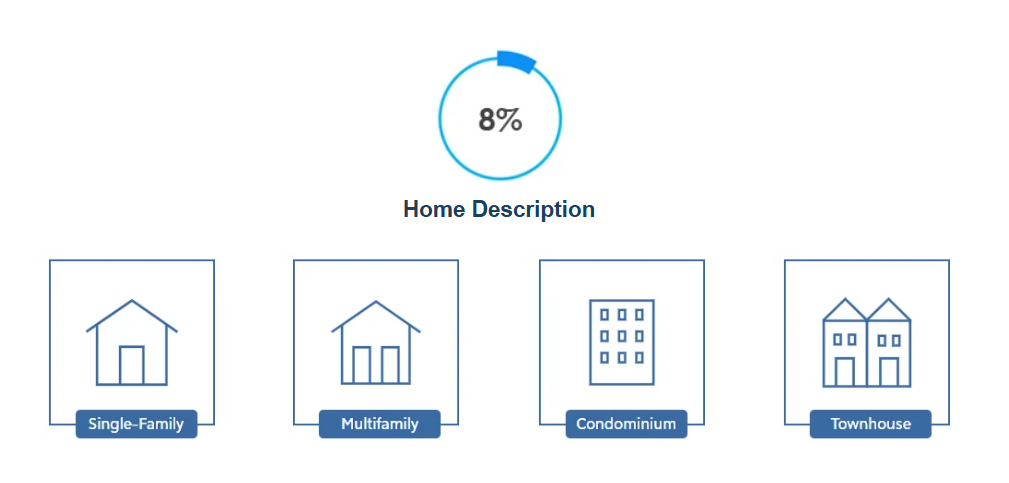

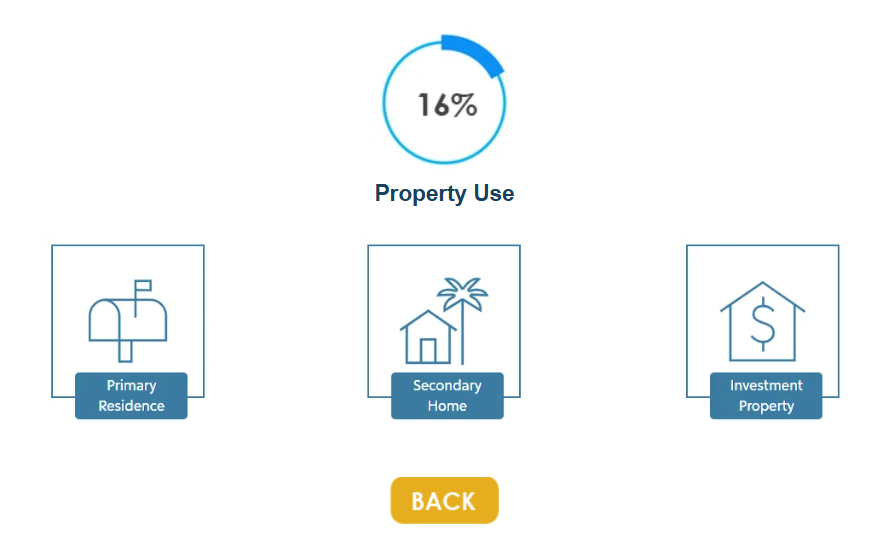

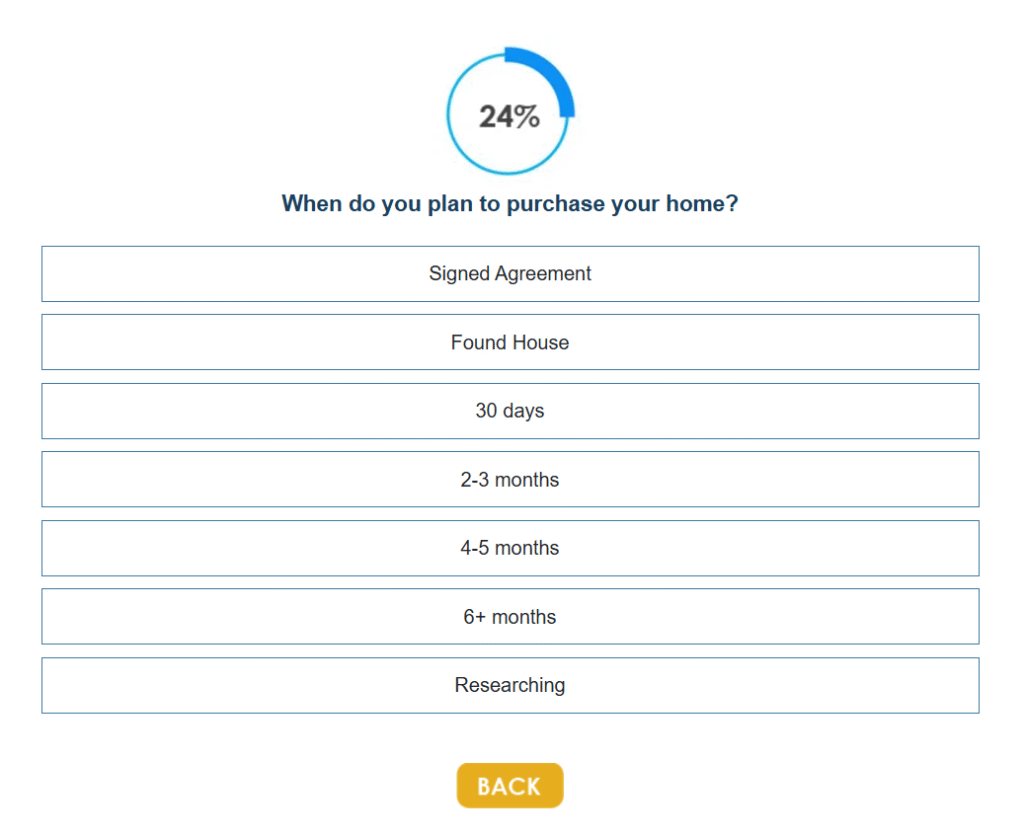

Tell Us More

Buyers can fill out a short form to give us a better understanding of their home buying needs and financial situation. This helps your Loan Officer-Realtor team to service your needs better. No financial documents or credit checks are needed at this stage.

Homebuyer Resources

Buying a home is a journey—and you don’t have to go it alone. Our Homebuyer Resources hub offers everything you need to make well-informed decisions at every stage: from credit tips and budgeting tools, to down payment strategies and mortgage comparisons. Available 24/7 to you.

FHA Loans

FHA Loans have lenient credit standards as compared to conventional loans.

FHA Loans will allow credit parameters that are not acceptable on conventional loans. FHA loans offer higher debt to income ratios, manual underwriting and the use of non-traditional tradelines. Manual underwriting offers the underwriter leeway to underwrite to FHA requirements when the borrower’s credit file is not accurate.

We're Here To Help

We’re always happy to chat, but sometimes you need to do things at your own pace. Our tools and resources are available whenever you need them.

527 Sycamore Valley Rd W, Danville, CA 94526

Toll Free Call : (866) 280-0020

For informational purposes only. No guarantee of accuracy is expressed or implied. Programs shown may not include all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval. Some products may not be available in all states and restrictions may apply. Equal Housing Opportunity.

Interactive calculators are self-help tools. Results received from this calculator are designed for comparative and illustrative purposes only, and accuracy is not guaranteed. Shining Star Funding is not responsible for any errors, omissions, or misrepresentations. This calculator does not have the ability to pre-qualify you for any loan program or promotion. Qualification for loan programs may require additional information such as credit scores and cash reserves which is not gathered in this calculator. Information such as interest rates and pricing are subject to change at any time and without notice. Additional fees such as HOA dues are not included in calculations. All information such as interest rates, taxes, insurance, PMI payments, etc. are estimates and should be used for comparison only. Shining Star Funding does not guarantee any of the information obtained by this calculator.

Privacy Policy | Accessibility Statement | Term of Use | NMLS Consumer Access

CMG Mortgage, Inc. dba Shining Star Funding, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025. To verify our complete list of state licenses, please visit www.cmgfi.com/corporate/licensing