Bank Statement Loans

Bank Statement loans are ideal for Self Employed Borrowers who have filed Low or No income tax returns but looking to qualify for more home.

Bank Statement Loans do not require any Tax returns, W2s or paystubs. We calculate your income based on the last 12 months gross deposits in your Business or Personal bank statements. We are not concerned with your account balances, just the gross deposits in the last 12 months. This makes it easy to qualify for larger loans since income is calculated based on your gross deposits. Bank Statement Loans are available for purchases and Refinances. Primary Homes,Investment Properties and Second Homes are eligible. One to four unit properties, Townhouses and Condos are covered. US Citizens, Permanent and Non Permanent Residents are also eligible.

These loans offer flexibility. We offer options for 1 year self employment, No reserves and lower credit scores.

We want to be part of your Journey!

We believe finding the perfect home is a life-changing experience, not just a transaction. Whether you’re upsizing, downsizing, or starting fresh, we’re here to guide you with trust, care, and expertise every step of the way.

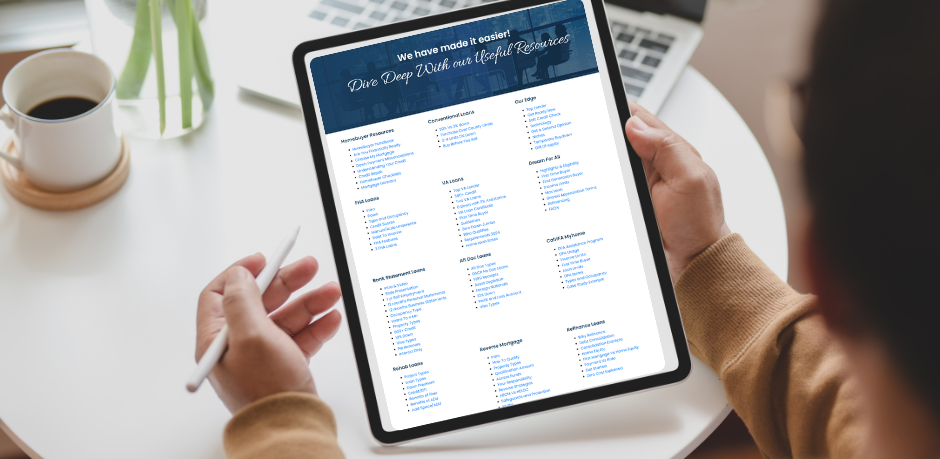

Homebuyer Resources

Buying a home is a journey—and you don’t have to go it alone. Our Homebuyer Resources hub offers everything you need to make well-informed decisions at every stage: from credit tips and budgeting tools, to down payment strategies and mortgage comparisons. Available 24/7 to you.

Get Fully Underwritten Before Your Offers

We ALL want a competitive edge. Our clients DESERVE a competitive edge. This is where Fully Underwritten Approvals play a valuable role.The underwriter has reviewed income, assets and liabilities to render a full approval for the borrower, even before the borrower has identified a property to purchase.

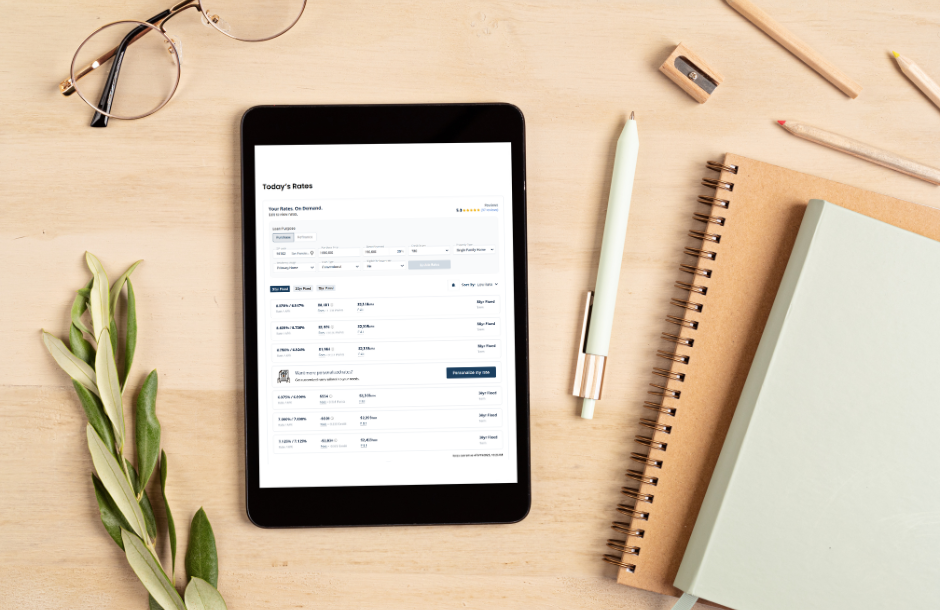

Mortgage Rate

Understanding current mortgage rates is essential for anyone planning to buy or refinance a home. Watch our short video below to learn more about the current mortgage rates —see what rate you might qualify for, what your monthly payments could look like, and how even small changes in rate can impact your budget.

DSCR Loans

Investors, looking to build a portfolio of properties? Our DSCR loans offer MAXIMUM flexibility. No W2s, paystubs and tax returns are needed. Use our DSCR loans to build your first investment property or refinance cash out from existing investment properties to multiply your investment portfolio. The rental income stream is used in lieu of income documentation. We will ALSO fund DSCR Negative Cash flow properties where the rental income does not cover the monthly mortgage payments. Mortgage rates are COMPETITIVE and based on down payment, credit and rental income.

We're Here To Help

We’re always happy to chat, but sometimes you need to do things at your own pace. Our tools and resources are available whenever you need them.

527 Sycamore Valley Rd W, Danville, CA 94526

Toll Free Call : (866) 280-0020

For informational purposes only. No guarantee of accuracy is expressed or implied. Programs shown may not include all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval. Some products may not be available in all states and restrictions may apply. Equal Housing Opportunity.

Interactive calculators are self-help tools. Results received from this calculator are designed for comparative and illustrative purposes only, and accuracy is not guaranteed. Shining Star Funding is not responsible for any errors, omissions, or misrepresentations. This calculator does not have the ability to pre-qualify you for any loan program or promotion. Qualification for loan programs may require additional information such as credit scores and cash reserves which is not gathered in this calculator. Information such as interest rates and pricing are subject to change at any time and without notice. Additional fees such as HOA dues are not included in calculations. All information such as interest rates, taxes, insurance, PMI payments, etc. are estimates and should be used for comparison only. Shining Star Funding does not guarantee any of the information obtained by this calculator.

Privacy Policy | Accessibility Statement | Term of Use | NMLS Consumer Access

CMG Mortgage, Inc. dba Shining Star Funding, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025. To verify our complete list of state licenses, please visit www.cmgfi.com/corporate/licensing