Jumbo Loans

If you have been offered a smaller jumbo loan, than requested or been turned down, we possibly can help.

Our Buy Before you Sell product allows you to buy another home before selling your current home.Your down payment for your new home may come from equity in your current home. We exclude ALL the debt on your current home, allowing you to qualify for more home. We have jumbo products with high debt to income, lower down payment and reserve requirements.Our bank Statement jumbo loans allow you to qualify without tax returns. If you have employment gaps or have not received restricted stock income for 2 years, we could help.

We have interest only and 40 year term loans to keep your monthly mortgage manageable.

We want to be part of your Journey!

We believe finding the perfect home is a life-changing experience, not just a transaction. Whether you’re upsizing, downsizing, or starting fresh, we’re here to guide you with trust, care, and expertise every step of the way.

Get Fully Underwritten Before Your Offers

We ALL want a competitive edge. Our clients DESERVE a competitive edge. This is where Fully Underwritten Approvals play a valuable role.The underwriter has reviewed income, assets and liabilities to render a full approval for the borrower, even before the borrower has identified a property to purchase.

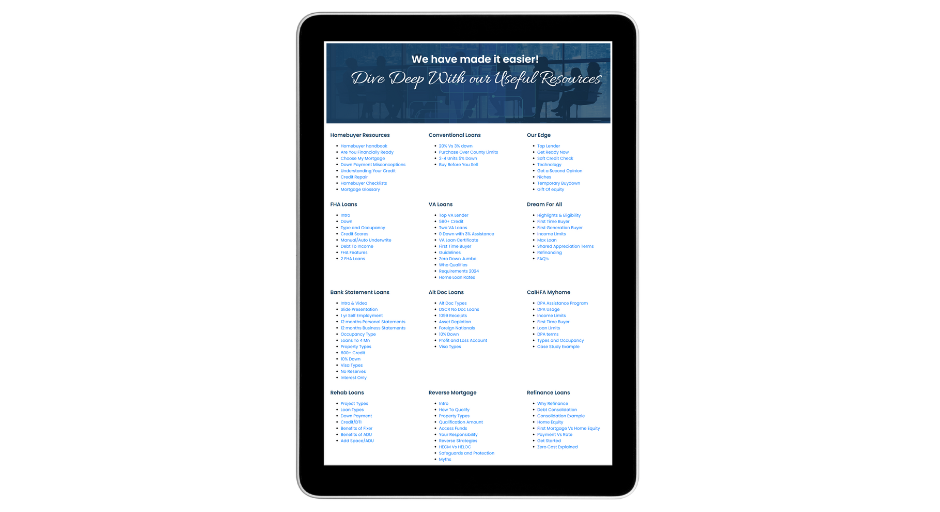

Homebuyer Resources

Buying a home is a journey—and you don’t have to go it alone. Our Homebuyer Resources hub offers everything you need to make well-informed decisions at every stage: from credit tips and budgeting tools, to down payment strategies and mortgage comparisons. Available 24/7 to you.

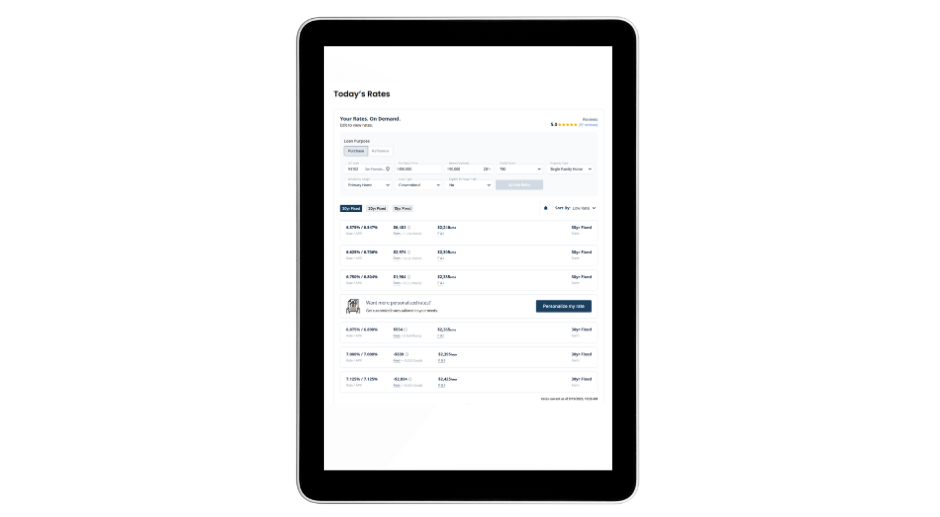

Mortgage Rate

Understanding current mortgage rates is essential for anyone planning to buy or refinance a home. Watch our short video below to learn more about the current mortgage rates —see what rate you might qualify for, what your monthly payments could look like, and how even small changes in rate can impact your budget.

Bank Statement Loans

Shining Star Funding provides Bank Statement Loan programs designed especially for self-employed individuals, entrepreneurs, and business owners who may not have traditional income documentation. Instead of relying on tax returns or W-2s, this loan option uses 12 to 24 months of personal or business bank statements to verify income. This flexible approach makes homeownership possible for borrowers with strong cash flow but complex finances. Whether you are purchasing a home, refinancing, or investing in real estate, Shining Star Funding’s Bank Statement Loans offer competitive terms, personalized service, and the opportunity to qualify based on real income strength, not paperwork limitations.

We're Here To Help

We’re always happy to chat, but sometimes you need to do things at your own pace. Our tools and resources are available whenever you need them.

527 Sycamore Valley Rd W, Danville, CA 94526

Toll Free Call : (866) 280-0020

For informational purposes only. No guarantee of accuracy is expressed or implied. Programs shown may not include all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval. Some products may not be available in all states and restrictions may apply. Equal Housing Opportunity.

Interactive calculators are self-help tools. Results received from this calculator are designed for comparative and illustrative purposes only, and accuracy is not guaranteed. Shining Star Funding is not responsible for any errors, omissions, or misrepresentations. This calculator does not have the ability to pre-qualify you for any loan program or promotion. Qualification for loan programs may require additional information such as credit scores and cash reserves which is not gathered in this calculator. Information such as interest rates and pricing are subject to change at any time and without notice. Additional fees such as HOA dues are not included in calculations. All information such as interest rates, taxes, insurance, PMI payments, etc. are estimates and should be used for comparison only. Shining Star Funding does not guarantee any of the information obtained by this calculator.

Privacy Policy | Accessibility Statement | Term of Use | NMLS Consumer Access

CMG Mortgage, Inc. dba Shining Star Funding, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025. To verify our complete list of state licenses, please visit www.cmgfi.com/corporate/licensing